E&R project | LOCO

Step 1 → Let's understand the product

🚀 Core value proposition:

‘To become the home of Indian Gaming’.

We specialize in UGC-driven eSports streaming & gaming content.

Exclusive partnerships with India's top streamers, eSports teams, and best-in-class tournament organizations fuel Loco’s positive growth trajectory.

We are backed by leading investors including Krafton, Sequoia Capital, Hiro Capital, and 3one4 Capital.

Loco fundamentally has two kinds of users - Viewers and Streamers.

💁♀️ How do users experience the core value prop of the product?

- Viewers (enabler: the host of streamers/features we have in-app)

- by watching streams from different creators/the same creators daily/weekly

- by watching eSports content from their favorite eSports organizations

- by purchasing the loyalty program to experience ad-free viewing

- IAP to interact with streamer chats + purchase vouchers

- Streamers (enabler: the $$ that we pay streamers + the community Loco offers)

- by streaming their favorite games

- by hosting watch parties of tournaments &

Please note, that the mechanics of retaining streamers are very closely related to how talent management (relationship management/payment terms++) comes into play, and participation of streamers is not directly correlated with how the streamers experience the app - hence for this project, we will be focusing on the viewer persona.

⏱️ The natural frequency of the core value proposition:

- Casual users: Once in 2-3 months

- Core users: Twice a month

- Power users: Once/twice a week or more

📈 Offerings in-app against these three kind of users:

What we offer | VIP loyalty program | eSports/gameplay streams | Top streamer content |

|---|---|---|---|

Contains | Perks such as ad-free viewing, special badge, VIP leaderboards (users earn money) ++ | BGMI tournaments hosted by eSports orgs/BGMI gameplay | Content streamed by super popular streamers (regional) |

JTBD | Improve user viewing experience (functional goal) + help viewers earn (financial goal) | Allow users to watch LIVE action with friends (personal goal) | Allow users to watch their favorite streamers and feel closer to them (personal goal) |

Casual | 0-1 times a month (such low frequency since this feature is high commitment wrt $$) | 2-3 times a month | 2-4 times a month |

Core | 2-5 times a month | 4-6 times a month | 5-9 times a month |

Power | >6 times a month | >7 times a month | >10 times |

💠 Engagement Framework for the product:

For Loco, Frequency and Depth are the two applicable frameworks:

- Reasoning:

- Since we're dealing with an app, some metrics such as DAU, MAU, number of stickers sent on chat, number of VIP programs purchased, and repeat purchasing users (D0 - D7 - D30) might not be our north star metrics - but they are major signals of how we are doing from an acquisition/retention POV. Hence, Frequency is a key engagement framework.

- Another key framework is Depth - since 'how much time is the user spending on the app?', 'what is the average watch time of our users', 'what is the amount being spent per user?', 'what is the video duration of the streams that our users are watching' are ALL critical questions that help us deepen our understanding of the level of engagement of our users - and help us double down on how users are spending time on the app.

Step 2 → Define

🧠 Define the action that makes a user an active user

An active user on Loco:

- is one who has a watch time of over 2 hours in a month

- is one who has successfully purchased the VIP pack at least twice in a month

- is one who has sent >25 stickers in a week on streamer chats

📱 Natural Frequency of users:

- Casual users: Once in 2-3 months

- These users usually browse the app to watch their favorite streamers/ gameplay and/or interact with the spin-the-wheel feature in-app to win diamonds

- E.g.: New users who have just discovered Loco's different features and are checking out different streamers/gameplays until they arrive at ones they truly like (yet to achieve their 'AHA' moment)

- Core users: Twice a month

- Typically users who are loyal to a particular streamer and whose behavior is dictated based on when their favorite streamer streams.

- E.g.: Thoppi fans who have their notifications on for when this streamer comes online. They have not engaged with features beyond watching their favorite streamers.

- Power users: Once/twice a week or more

- These folks are either avid eSports fans or/and VIP program loyalists.

- E.g.: eSports fans who diligently watch all days of the stream despite it being behind a paywall.

Step 3 → Segmentation

A. Persona-based Segmentation (ICP)

Consumer persona type | Persona | Bio | Demographics | Motivation to use Loco - JTBD | Pain points | Engagement/User behaviour | Natural frequency | Power/Casual/Core |

|---|---|---|---|---|---|---|---|---|

User persona 1 | eSports Enthusiast | Name: Aryan Koli Gamer Competitor player |

|

|

|

other fans in the Loco chat and sometimes it becomes a heated argument with rivalry team fans | 1-2 times in a week | Power/Core (users tend to lie in one of these two brackets) |

User persona 2 | Incentive/Reward based viewer | Name - Vishnu Loves Free Fire |

|

|

|

| 1-2 times in a week | Power/Core (users tend to lie in one of these two brackets) |

User persona 3 | Gaming Entertainment Enthusiast | Name - Vikalp PUBG fan |

|

|

|

| Once in 2-3 months | Casual |

User persona 4 | Game Streamer Superfan | Name - Edwin Dilson |

|

|

|

| 2-3 times in a month | Core |

B. Power/Core/Casual Segmentation:

User Type | Power | Core | Casual |

|---|---|---|---|

Usage Characteristics |

|

|

|

Other traits |

|

|

|

Corresponding ICP(s) |

|

|

|

Pain Points |

|

|

|

Example story | Roshan is from Varanasi, he has bought many diamonds and is waiting for the app to bring back the leaderboard. He spends 2-4 hours on the app daily watching BGMI streams. He is an ardent fan of watching tournaments on the app. He downloaded Loco to watch streams - he loves watching gameplay. | Krishna is from Cochin, India. He thoroughly enjoys watching Thoppi's streams. He used to pay for VIP to avail the sticker feature (ie to send stickers to Thoppi on chat). He will follow Thoppi across platforms. | Ragini is from New Delhi and enjoys watching vlogs of her favorite streamers, fun watch parties. She's browse through the trending content on Loco's app to find such enthusing content, as she watches the stream - she'll send not more than 1-2 stickers to engage with the chats. |

Step 4 → Engagement

Let's crack user engagement on the app.

🪝 Product hooks

There are two product hooks that we can explore to engage with all three users - casual, core, and power.

🎁 Product hook 1: Streamer Giveaways and Watch Parties

- Goal: To engage users who visit the app to watch streams by integrating giveaways and watch parties.

- Success Metric:

- Watch time increases by 20% for power users

- Watch time increases by 10% for core users

- Watch time increases by 2.5%-3% for casual users

- Problem Statement:

- Users LOVE watching gameplay with their favorite streamers. They want to feel closer to their favorite streamers by seeing what they have to say about different gameplay/matches.

- Users want to feel some sense of gratification when watching streams from their favorite streamers

- Current Alternative:

- Users watch streams of their favorite gaming categories + streamers. Content + streamers pull has to be HIGH to get users to watch for a significant period.

- Solution:

- Summary: Weekly streamers giveaways + BGMI gameplay/tournament watch parties

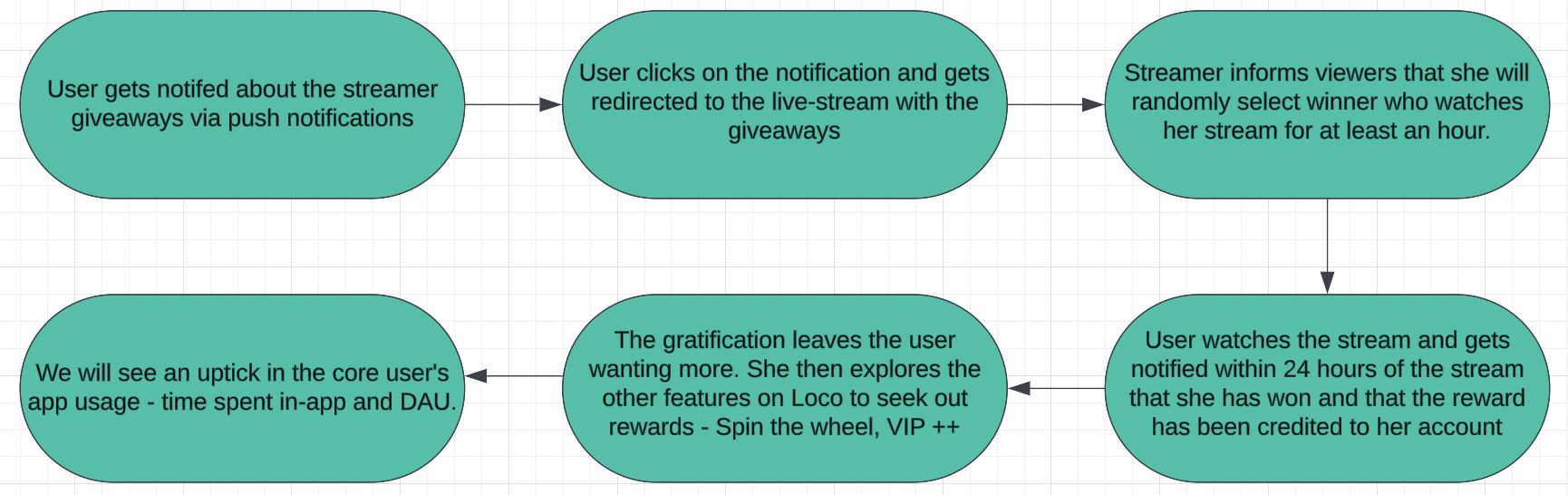

- Detailed version with user flow

- Step one: User will get notified via push notifs about enticing goodies being offered via giveaways

- Step two: The user clicks on the link -> is redirected to the relevant Live-stream

- Step three: The gifting selection process will be directly linked to a higher watch time - so users will stick around to watch the stream -> watch time goes up over time (with higher frequency of this activity)

- Metrics to track:

- CTR of Push notifications where these hooks are being announced

- Average CCU (concurrency) of the streams of streamers who are hosting giveaways

- Total watch time uptick WoW

- Ramp-up milestones:

- Phase one: Roll it out to reward ICP + eSports ICP cohorts (power cohorts)

- Phase two: We will up the ante with the kind of giveaways being offered (wrt $$) -> roll out the product hook to core user segments

- Phase three: Activate premium streamers for the watch parties -> roll out the product hook to casual user segments

🎢 Product hook 2: VIP Program Revamp ie VIP 2.0

- Goal: Boost user engagement by reactivating past VIP users, retaining VIP users, and bringing in new VIP users by beefing up the perks offered.

- Success Metric:

- D0 to D30 retention % should ideally be in between 10-15%

- Problem Statement:

- Users who make the first-time purchase do NOT purchase a second time as they don't see value in the purchase.

- Current Alternative:

- The alternative is to NOT be a VIP program holder, basically, a free user.

- Solution:

- Summary: We'll bulk up the offerings that come with the VIP loyalty program to ensure we're enticing folks to continue being VIP holders AND encourage folks to join the program.

- Offerings will include:

- More quality VIP-only streams

- More VIP leaderboards (VIPs who are in the top 20 win money)

- More VIP special rewards - BGMI UC + vouchers

- Detailed version with user flow

- Step one: Existing VIP users, previous VIP users are notified about the new offerings via notifications + paid ads

- Step two: Targeted users are intrigued -> they try out the NEW VIP program via a two-day trial

- Step three: On the third day they are presented with an in-app pop-up nudging them to purchase the VIP pack

- Metrics to track:

- % of revived VIP users (core segment)

- M2 retention of VIP users (power segment)

- D30 retention % of new VIP users (across segments)

- % of new VIP users (casual segment)

- Ramp-up milestones:

- Phase one: Roll it out to VIP users whose membership is about to end

- Phase two: Roll it out to ex-VIP users who did not renew in the last 30 days

- Phase three: Publish in-app inventory pushing the NEW VIP program to all users

🎙️ Engagement campaigns

Content | Campaign #1 | Campaign #2 | Campaign #3 | Campaign #4 | Campaign #5 |

🔮 Name | Go Loco Giveaways Bonanza | S8ul Creators Celebration Week | VIP 2.0 (Power) | VIP 2.0 (Core) | BGIS Week!! |

🪝 The hook | Hook 1: Streamer Giveaways | Hook 1: Streamer Giveaways | Hook 2: VIP program revamp | Hook 2: VIP program revamp | Hook 1: Watch parties |

👨👨👧👧 Segmentation | Engage Core users; Core -> Power | Engage Casual users; Casual -> Core | Engage Power users; Power -> Power (Retain) | Engage Core users; Core -> Power | Engage Core users; Casual -> Core |

🥅 Goal | To see an uptick in the core user's app usage - time spent in-app and DAU. | To help casual users see value in what the app has to offer via TOP streamer content & giveaways and to see an up-tick in the frequency of casual users. | There needs to be an uptick in the D30 retention of existing VIP users. | There needs to be a D7 uptick in the retention of freshly revived VIP users. | Average watch time needs to see an uptick of at least 10% after the campaign. |

🎤 Pitch/Content | Unlimited giveaways just for you! | Win BIG with S8ul! | Renew your membership and get 10UCs for free! | Become a VIP and earn BIG with VIP leaderboards worth 30K & UC rewards! | Watch BGIS with your favorite streamers. Experience unlimited fun with the best ❤️ |

🗾 Channels | Notification campaigns (push notifs + in-app), Social media (own + paid) | Notification campaigns (push notifs + in-app) , Social media (own + paid) | Notification campaigns (push notifs + in-app) | Notification campaigns (push notifs + in-app) , Social media (own + paid) | Notification campaigns (push notifs + in-app) , Social media (own + paid) |

🎁 Offer | Google Play vouchers, Amazon vouchers, UCs ++ | Google Play vouchers, Amazon vouchers, UCs, iPhone 5, PS5 up for grabs! | 10UCs for free! | VIP leaderboards worth 30K & UC rewards | BGMI gameplay with TOP streamers |

⏳ Frequency/Timing | Will take place once a week | Will take place once in two months | One time | One time | Depending on the BGMI eSports Calendar |

✅ Success metrics |

|

|

|

|

|

Campaign #1: Go Loco Giveaways Bonanza

Campaign #2: S8ul Creators Celebration Week

Campaign #3: VIP 2.0 (Power)

Campaign #4: VIP 2.0 (Core)

Campaign #5: BGIS Celebration Week:

Step 5 → Retention

🔭 Bird's eye view:

Since our current focus as a company is to maximize transacting users, we'll be looking at revenue retention. Data has shown us time and time again, that - once a user transacts one time - the probability of them purchasing again, becomes significantly higher. More so, the users who transact one time, AND claim their reward - their retention % MoM over three months is a larger % of the previous data point. At a platform level, our M1 PU (purchasing user) retention is 25.40% and D30 PU retention is 5.55%.

🔍 Let's take a deeper look into revenue retention charts:

PU Daily Retention - Purchase to Purchase - by Cohort gives us the following chart:

Before we double-click on the data for the different cohorts mentioned in the chart above, let us first define what the cohorts mean/stand for:

- Non-claiming VIP users: Once a user becomes a VIP user, there are VIP leaderboards that members can partake in by sending stickers on a stream chat. If they rank highly on the leaderboard, then the members win gifts (money). There are a bunch of folks who win but don't claim their rewards, their cohort is titled 'Non-claiming VIP users'. Alternatively, users who claim their gifts are titled as 'VIP Gift Claimed'.

- Esports PUs: To watch BGMI tournament streams, users had to become a VIP. These streamers are termed 'Esports PUs'

- Non-esports PUs: We had VIP streams that users would avail of only if they were VIP members. The incentive for wanting to watch the stream was to participate in the leaderboards - just so they could earn money.

- VIP winners: Users who were VIPs -> participated in VIP leaderboards -> ranked in the top 20 -> hence were declared winners.

All PUs | Retention rates |

D1 | 9.96% |

D7 | 8.15% |

D30 | 5.55% |

Esports PUs | |

D1 | 21.60% |

D7 | 14.90% |

D30 | 17.60% |

Non-Esports PUs | |

D1 | 9.50% |

D7 | 7.88% |

D30 | 5.07% |

VIP Winners | |

D1 | 20.20% |

D7 | 19.10% |

D30 | 13.40% |

VIP Gift Claimed | |

D1 | 20.50% |

D7 | 17.80% |

D30 | 12.70% |

Non-Claiming VIP Winners | |

D1 | 12.80% |

D7 | 12.80% |

D30 | 8.05% |

Important observation in the data above - D30 revenue retention of the eSports cohort is the highest, followed by the VIP cohort who won the VIP leaderboards aka 'VIP winners'

Next, we'll look at: PU Monthly Retention - 1st Purchase to Purchase

Let's double-click on the data:

All PUs | Retention rates |

M1 | 25.40% |

M2 | 14.70% |

M3 | 9.50% |

Esports PUs | |

M1 | 85.10% |

M2 | 60.80% |

M3 | 54.40% |

Non-Esports PUs | |

M1 | 23.00% |

M2 | 12.90% |

M3 | 7.29% |

VIP Winners | |

M1 | 59.30% |

M2 | 34.80% |

M3 | 22.40% |

VIP Gift Claimed | |

M1 | 52.80% |

M2 | 33.90% |

M3 | 22.20% |

Non-Claiming VIP Winners | |

M1 | 52.30% |

M2 | 16.80% |

M3 | 9.68% |

From these insights, it is clear that the eSports cohort and Rewards/Incentive-based cohorts drive the BEST retention. The most effective channels that we have used to push the VIP program, and the rewards we have on our app - are Google ads, and social media (owned + streamer-led marketing).

The features - in tandem with the high-impact ICPs identified are eSports tournaments, and the VIP loyalty program on Loco.

💜 Key observations:

- There is high retention among purchasing users OVERALL - especially ones who have reaped the benefits of winning, ie earning gifts; AND VIP users who joined JUST to watch BGMI tournament streams.

- VIP winners who claim gifts have a higher retention rate than those who DO NOT.

- Widening the TOFU for purchasing users is key to experiencing Loco's significant retention rates at a large scale.

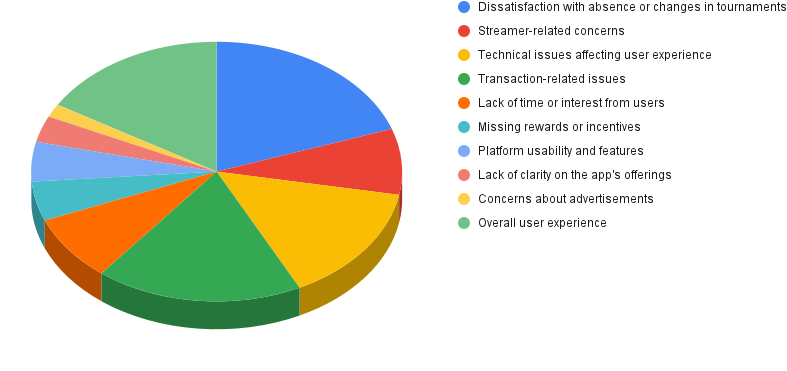

🥺 Why are users churning?

Now let us double-click on why users have churned, basis the user calls that took place, and mention what is in our hands and what isn't:

- Video quality is poor: Voluntary

- Too much data is consumed in streaming data: Voluntary

- No giveaways taking place in-app: Voluntary

- Moved to a competitor app since their friends are there: Involuntary

- Not satisfied with how much they are earning with the VIP program: Voluntary

- Not satisfied with the benefits of the VIP program: Voluntary

- Their favorite streamers are not streaming on the app anymore: Voluntary

- The app is too glitchy: Voluntary

- Unable to find content in their regional language: Voluntary

- No eSports content: Voluntary

- Was not able to successfully pay for diamonds in-app: Voluntary

- Not able to claim VIP gifts from the app: Voluntary

- Not happy with the rewards available in the app: Voluntary

- Moved out of the country: Involuntary

Further info is bifurcated in the chart below:

🔻Negative actions that signal churn:

- PU retention WoW & MoM drop

- Business impact: Revenue will take a hit.

- Disabling Push Notifications

- Business impact: A reliable channel to reach all users will be lost. Hence CAC will go UP significantly.

- App uninstalls will go up

- Business impact: Lost revenue, negative WOM

- Poor app store reviews

- Business impact: Losing out on potential users/revenue, negative WOM

- Drop in DAU, MAU - drop in frequency of app usage

- Business impact: Revenue takes a hit.

- Users are not willing to pay to watch esports streams anymore

- Business impact: Revenue takes a hit. Tournament organizers are disappointed and hence will not work with us going forward - will be more difficult to organize eSports tournaments.

- The frequency of VIP pack purchases drop

- Business impact: Lost revenue.

🐣 Resurrection campaigns:

| Campaign #1 | Campaign #2 | Campaign #3 | Campaign #4 | Campaign #5 |

|---|---|---|---|---|---|

Theme | VIP bonus | VIP spin the wheel with bigger/better rewards: to add as a USP. | Double down on VIP-only giveaways with TOP streamers to build FOMO + surface them on the app more so that peope SEE what they are missing out on. | Host limited-timed events - where we beef up the offerings for VIP | VIP trials packs |

User-type | Resurrect Power users who churned because they weren't happy with how much they were earning due to the highly competitive nature of the VIP leaderboards. More number of winners implies lesser $$ per winner. | Resurrect Core users who churned because they did not want to participate in highly competitive VIP leaderboards to reap the benefits of being a VIP. Also, to win a VIP leaderboard, a streamer needs to watch the entire stream - which would not be necessarily natural to a core user. So a low-stake spin-the-wheel activity with high-ticker rewards + ad-free viewing would entice the churned user to give the new VIP feature a shot. | Resurrect core & casual. While core users will be more likely to care about the streamers who we'll be roping in - since they're more likely to be gaming enthusiasts; the casual users will more likely be enticed by the ticket sizes of the giveaways being offered. This activity paired with a discounted VIP pack for casual users will nudge them to give the app a shot again. | Resurrect Power users. Since Power users were heavily invested in the app at some point in the past - introducing a FOMO-driven, limited-time event which solves their primary pain point of not earning enough ie ROI of being a VIP did NOT make sense to them - a campaign such as this should work. | Resurrect casual and core users. It is important to note that this campaign will run ONLY when all the VIP features are up and running ie VIP leaderboards, Spin-the-wheel, ad-free viewing ++ So that the users who resurrect get the full experience of being a VIP once they start their trial. A trial allows users to experience the Revamped VIP program (refer to: product hook 2) for first time. |

Pitch/content | Users who send stickers get a VIP bonus, regardless of the leaderboard rankings. | Widen TOFU + VIP user retention + revive ex-VIP users | Users who visit the app should be reminded more often about what exactly they’re missing out - in the trending view itself, it should be marked - the streams that cannot be viewed. So even if the user wasn’t considering watching that particular stream, the fact that they cannot view it WILL drive some level of FOMO. This pattern is contingent to the content/streamer being lucrative. The streamer must be a popular streamer with a loyal fanbase - ideally a mix of creators from the Southern belt of India. | Widen TOFU + VIP user retention + revive ex-VIP users | Nudging casual & core users who churned to give the VIP pack a shot |

Offer | Users who send at least 10 stickers OR the value of the stickers sent have to add up to 75 diamonds. The bonus will be 10 diamonds which will be credited within 24 hours. | Since we have this feature in the works, we could add a layer wherein VIP users get access to a special wheel with special VIP features such as: more diamonds up for grabs + a prezzie from a streamer + an extended VIP pack | VIP-only giveaways including PS5, and Google Play vouchers worth ₹1,500+. | VIP leaderboard value will get bumped up from 10K to 50K for an hour twice every week. So VIP users can win more money by participating in the streams (sending stickers). |

|

Frequency and timing | Once in two weeks - the relevant cohort will be targeted via push notifications as and when the VIP bonus feature goes Live. | It's a feature tweak - will be always available to all VIP users. The ex-VIP users will be targetted using notification channels, and the existing VIP users (closing in on expiry) will be targetted using in-app inventory | 2-3 VIP-only giveaways every week. The days will be fixed so users will know when to expect the giveaways. We'll design notification campaigns to ensure that every time a streamer goes Live, the relevant cohorts will get notified. Will run come paid ads as well, just to reach out to casual users who have most likely muted our notifs. | Twice every week for an hour. Notification campaigns (push notifs) will be used to notify ex-VIP users. And in-app notifs for VIP users whose packs are about the expire. | One-time campaign. The campaign will be communicated using paid ads, social media + notification campaigns - since casual churned users will have muted our notifications most likely. |

Success metrics | >25% of ex-VIP users are revived. | >35% of ex-VIP users are revived; >70% of the existing VIP users will renew their VIP pack. | >35% of ex-VIP users are revived; >45% of the existing VIP users will renew, >20% of non-eSports users (likely to overlap with ex-VIP users) | >25% of ex-VIP users are revived; >35% of the existing VIP users will renew, an overall uptick in PU by 5% | >30% of core users & >5% of casual users who churned and did not want to pay to experience VIP |

The churn pain point that is being addressed | 'Not satisfied with how much they are earning with the VIP program' | 'Not satisfied with how much they are earning with the VIP program' | 'Not satisfied with how much they are earning with the VIP program' 'No giveaways taking place in-app' | 'Not satisfied with how much they are earning with the VIP program' 'No giveaways taking place in-app' | 'Not satisfied with the benefits of the VIP program' |

Please note: While we earlier observed that the eSports user cohort was promising wrt revenue retention - roping in streaming rights is a lengthy & very expensive affair AND organizing tournaments with tournament organizers (TOs) is too dependent on the relationships we have built with them thus far + lengthy + expensive. Since the lead time of activities to tap into this cohort is tedious and unpredictable, I have NOT included any campaigns for them, ONLY VIP COHORTS resurrection campaigns.

Thank you!

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.